Going for the Gold

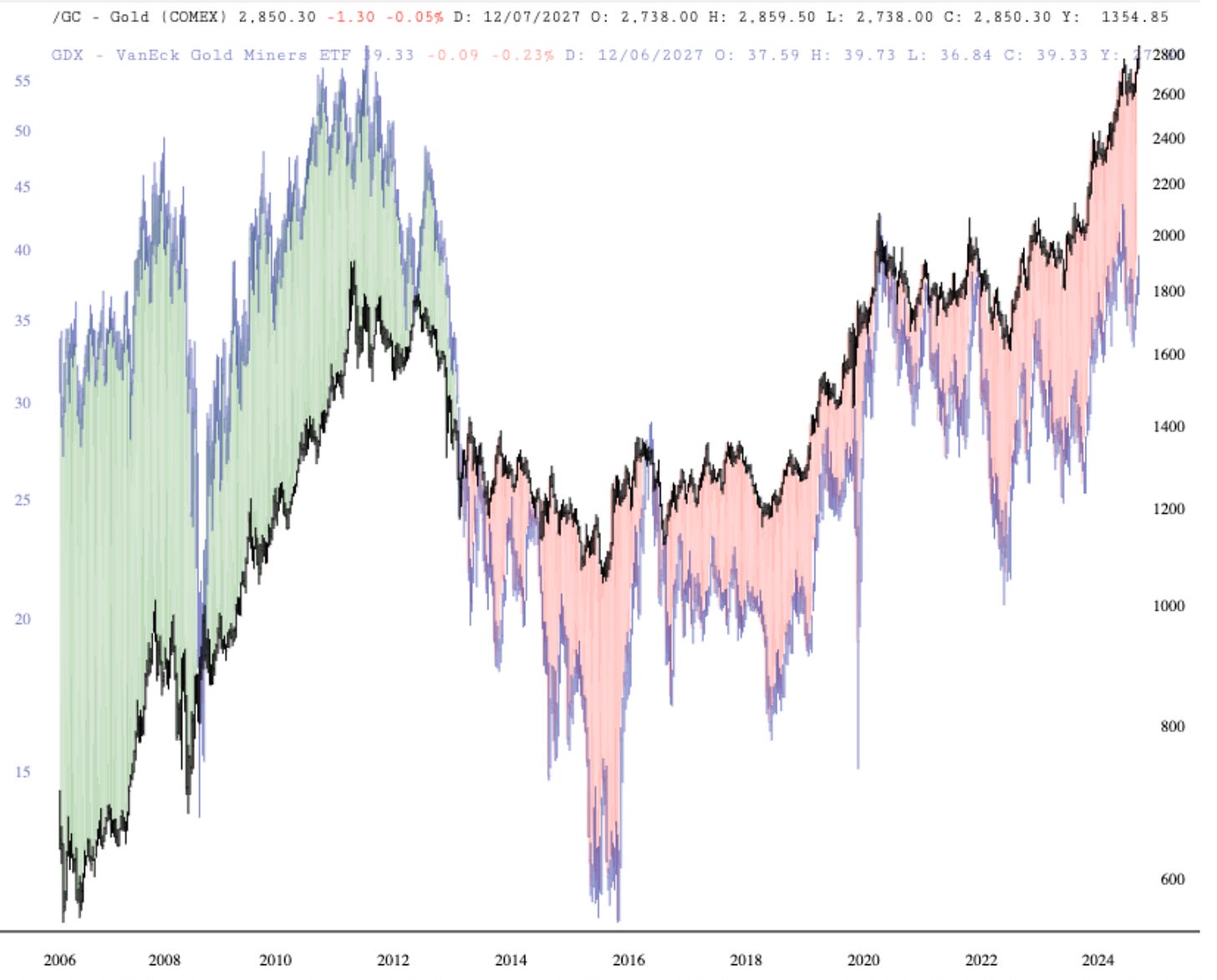

Gold hit new highs today. I still like the base metal of Gold and Silver vs miners simply to reduce country and company risks.

Bill Cara notes:

Do Not Sell Your Gold. The Chickens Have Come Home to Roost.

The London Bullion Market Association has leased out so much Gold that owners of the physical who want it returned are now waiting four weeks instead of four days. There is no physical to be found. Contracts are in technical default.

https://www.lbma.org.uk/

For background, this video is informative.

The narrative involves hoarding before Trump tariffs kick in, but I would not pay much attention. The only story is the price. Trade what you see!

The Bullion Banks and other members of the LBMA control group are at fault.

https://www.lbma.org.uk/membership/current-membership#-

There is no Gold to be found to back up the Bullion Banks’ short futures contracts. So the price will only rise until this physical Gold delivery mess can be sorted. So, they need your Gold. Please don’t sell it to them.

The price of Gold futures over recent years:

See Gold vs GDX

Below are a few interesting miners that stuck out to me accompanied by their P&F charts, where you can clearly see the market participants voting with their paper money.